Industry

Banking

Client

XP Investimentos

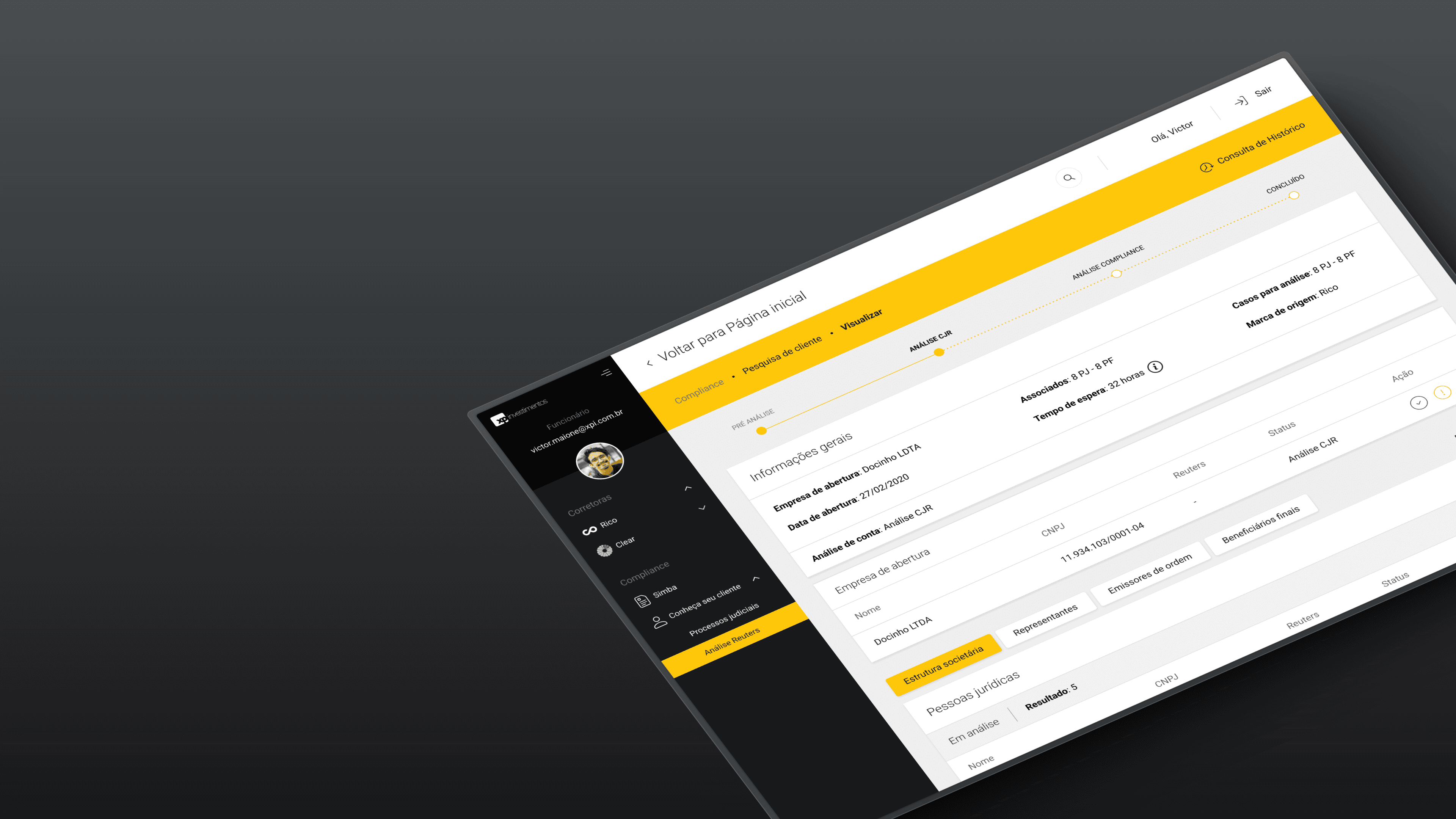

Simplifying the Corporate Web: Modernizing the KYC Process

Assessing potential risks during account openings through detailed post-account analysis.

Analysts previously had to sort through scattered physical documents and disorganized PDFs to assess risks. They researched corporate structures and partners individually, recording potential risks in spreadsheets. This manual process was time-consuming and prone to errors, requiring a complete overhaul.

A Complete Digital Transformation of the KYC Process. Digitalizing Paperwork and Reimagining Risk Sssessment Workflow.

We developed a product that enabled analysts to efficiently review entire corporate structures, seamlessly integrated with Reuters’ analysis tools. This digital transformation cut KYC analysis time from 5 days to just 3. The system offers categorized access to corporate structures for targeted reviews and includes a double-check mechanism to ensure data accuracy, driving efficiency and reliability across the process.

Projects